How Do Business Brokers Keep Your Business Sale on Track?

Deciding to sell your business is a big step. Between valuation, buyer search, financing, tax questions, and closing paperwork, it’s easy for details to slip and for momentum to stall. Business brokers exist to keep that complex process moving, from your first conversation about value to a completed handoff.

Clarify Your Goals and Timing

Before anything goes on the market, a broker will ask why you want to sell, what you hope to net, and when you would like to exit. The selling process starts with a candid discussion of your goals and expectations, so the rest of the plan is built around what you actually want from the sale. Those answers shape:

Whether you should sell now or wait

How aggressively to price the business

What kinds of buyers (individual, strategic, financial) make sense for your situation

Get a Realistic Valuation and Prepare Your Numbers

Next comes a professional valuation and a review of your financials. During this step, a broker may also flag gaps in your books. This helps you avoid overpricing (which scares buyers away) or underpricing (which leaves money on the table). Sunbelt’s selling tutorial explains how valuation and packaging work together to form a realistic asking range:

Analyze historic and current earnings

Normalize add-backs and one-time expenses

Compare your business to recent market data

Prepare the Business and Documents for Buyers

Once you understand value, brokers help you get the business ready for scrutiny:

Identifying operational issues (owner dependency, process gaps) that should be addressed before listing

Organizing key documents: leases, key contracts, licenses, corporate records

Helping you think through what is included in the sale (assets, inventory, employees, name, etc.)

Market the Business and Screen Buyers

With the groundwork in place, brokers create a confidential marketing plan. Their role here is to:

Write and manage blind listings that protect your identity

Tap buyer databases and networks without broadcasting the sale to staff or competitors

Require non-disclosure agreements (NDAs) before sharing sensitive details

Throughout this stage, they pre-qualify inquiries so you spend time only with serious, financially capable buyers. Sunbelt’s articles on selling with confidence describe how brokers balance broad exposure with strict confidentiality to protect your day-to-day operations while you sell your business.

Manage Offers, Due Diligence, and Closing

Once offers arrive, business brokers keep the deal moving by:

Comparing offers and structures (price, terms, contingencies)

Coordinating with your attorney and CPA on letters of intent and contracts

Keeping communication flowing during due diligence so concerns are addressed early

IRS guidance on closing a business highlights tax filings, employment obligations, and other compliance steps that must be handled as you exit. Brokers help you navigate those requirements in parallel with buyer requests so details don’t derail closing. Throughout these final steps, brokers act as process managers so you can stay focused on running the company until the transaction is complete. Working with a broker team means you’re not trying to manage valuation, preparation, marketing, due diligence, and closing alone. When each step is planned and guided by experienced business brokers, you’re far more likely to keep your business sale on track from first conversation through the final handshake.

How to Prepare Financial Records Before You Sell Your Business

Preparing financial records early is one of the most important steps when you plan to sell your business. Buyers rely on accurate information to evaluate risk, assess earnings, and understand long term performance. Clean documentation also helps business brokers represent your company clearly and prevents delays during negotiations. With organized records, buyers can move through the evaluation process with confidence.

Organize Your Core Financial Statements

Prospective buyers typically request at least three years of financial statements, including income statements, balance sheets, and cash flow reports. These documents should match your tax returns and internal accounting summaries. When records show consistency and accuracy, buyers can analyze performance without unnecessary follow-up questions. A well-prepared financial package helps establish trust and shows that your business operates responsibly.

Review Tax Filings for Accuracy

Tax returns serve as a primary confirmation source for buyers and lenders. Ensuring that internal statements align with filed returns reduces the chance of delays. If discrepancies appear, they should be corrected before listing the business. Buyers may also request proof of payment, submission confirmations, and correspondence with tax authorities. Organizing this information in advance helps keep momentum steady and reduces uncertainty.

Reconcile Accounts and Outstanding Balances

Reconciling bank accounts, credit lines, vendor balances, and customer invoices helps eliminate confusion during evaluation. Unreconciled items can slow down due diligence and raise concerns about bookkeeping practices. A professional business broker can help identify the reconciliations that matter most and recommend how to present them. Clean records show discipline in financial management and support a smoother review process.

Document Owner Adjustments

Many small and mid-sized businesses include expenses that would not continue under a new owner. Documenting these adjustments clearly helps buyers understand the company’s true earnings. Examples may include personal travel, owner benefits, non-recurring expenses, or discretionary spending. Creating a detailed schedule with explanations supports stronger valuation discussions and reduces time spent addressing buyer questions.

Prepare Customer, Vendor, and Contract Information

Revenue stability and supplier relationships influence buyer confidence. Preparing summaries of major customers, recurring contracts, and vendor agreements helps demonstrate predictable performance. Confidential details can remain protected until later stages, but organized summaries show that essential information is maintained carefully. This transparency supports faster early-stage evaluation and shows buyers that the business has structured processes.

Support Due Diligence With Organized Files

Once a letter of intent is signed, buyers begin reviewing detailed records. This may include payroll reports, inventory summaries, lease agreements, and loan documentation. Keep in mind that intellectual property should be protected, and contracts must clearly describe what belongs to the business and what is designated to other parties.

Organizing financial records early improves buyer confidence, strengthens negotiations, and supports a smoother path toward closing. With clear documentation and professional guidance, you help ensure that the transaction proceeds efficiently and with fewer obstacles.

How Long Does It Take to Sell Your Business in Today’s Market?

Many owners want a clear answer about how long it takes to sell your business once the process begins. Although timelines vary, most sales in today’s market take between four and nine months. Companies that prepare early, maintain clean records, and work closely with business brokers usually experience faster progress. Understanding the major stages helps set realistic expectations and supports better planning.

Preparation Before Listing

Preparation often takes several weeks and has a significant impact on the overall timeline. Sellers who gather financial statements, contracts, payroll records, and operational information early reduce the chance of delays. This stage also includes identifying strengths, challenges, and opportunities that buyers will likely evaluate. A professional business broker can review your documentation and advise which items need refinement before marketing begins.

Time on the Market

Once the business is listed, early interest usually arrives within the first few weeks. Serious buyers move through qualification before receiving detailed information. Business brokers confirm financial capacity, review acquisition experience, and ensure that inquiries reflect genuine intent. These steps protect confidentiality and help filter out casual shoppers. Most committed buyers progress from initial outreach to active review within thirty to sixty days.

Buyer Review and Engagement

Qualified buyers complete their first round of evaluation by reviewing high-level summaries, recent financial trends, and operational highlights. This stage often includes questions about staff, customer concentration, and growth opportunities. Businesses with consistent earnings and clear financials tend to attract faster engagement. Market conditions also influence speed. High buyer confidence and strong borrowing conditions often shorten time on the market.

Due Diligence and Negotiation

After signing a letter of intent, buyers begin formal due diligence. This phase generally takes thirty to forty-five days. The timeline depends on the quality of documentation and the responsiveness of both parties. Clean accounting records, updated contracts, and organized files help reduce delays. Negotiations related to closing terms, working capital, and transition support often occur at the same time. Clear communication helps maintain momentum.

Market Factors That Influence Timing

Industry demand, revenue stability, and economic conditions all affect how long the sale may take. Essential services and recurring revenue businesses often move faster because buyers view them as more predictable. Lending conditions and regional buyer activity also contribute to timing.

Tips to Improve Your Timeline

Prepare three years of financial statements before listing.

Maintain accurate bookkeeping and organize operational records.

Respond quickly to buyer questions to maintain engagement.

Review a related off-site article for additional context: https://www.sunbeltbusinessbrokersposts.com/blog/understanding-market-timing

For more information about planning your sale, consult a reliable business broker. Understanding the stages involved and preparing early helps create a smoother process. With the right approach and experienced guidance, you can navigate the market efficiently and work toward a successful transition.

5 Tax Issues Every Owner Must Consider Before Selling

Preparing to sell your business involves more than finding a buyer and agreeing on price. Taxes strongly influence how much of the sale proceeds you retain. Owners who plan early are better positioned to structure deals, time closing, and document expenses in ways that reduce liability while keeping the transaction compliant and on track.

Capital gains versus ordinary income

How proceeds are taxed depends on deal structure and entity type. A stock sale often favors capital gains treatment, while an asset sale can split amounts across ordinary income and capital gains. Allocations to items such as goodwill, inventory, and non-compete agreements change the tax mix. Clarify scenarios with your business brokers before letter-of-intent negotiations begin.

Depreciation recapture on fixed assets

Equipment, vehicles, and other depreciated assets may trigger recapture, which is generally taxed at ordinary income rates up to prior depreciation taken. Sellers who overlook this point can be surprised after closing. Inventory assets are typically ordinary income as well. Model the tax effect of asset classes early so your pricing and net-proceeds expectations remain realistic.

State and local considerations

Rules vary widely by state. Some jurisdictions impose additional taxes, surtaxes, or filing steps that affect timing and cash flow. If your company operates in multiple states, nexus and apportionment can complicate the picture. An experienced business broker and tax professional can synchronize federal and state requirements so your closing checklist is complete.

Timing and installment strategies

When the deal closes can change your bracket and your exposure to net investment income tax. Spreading payments through an installment sale may smooth taxes across years, though risks and interest-charge rules apply. Align the closing window with estimated income, retirement plans, and year-end deadlines to avoid preventable bracket creep and cash-flow stress.

Deductible costs and documentation

Many selling expenses reduce taxable gain, including brokerage commissions, legal fees, quality of earnings work, and marketing. Keep detailed invoices, engagement letters, and the final settlement statement. Good recordkeeping supports deductions and speeds any future questions from authorities.

Practical prep checklist

Begin tax planning months before listing.

Compare stock versus asset structures and model outcomes.

Inventory depreciated assets and estimate potential recapture.

Confirm state filings and payment schedules.

Centralize documentation for all deal costs.

For a deeper understanding of selling-a-business tax topics, a consultation with reputable business brokers is an excellent idea. To understand process steps and confidentiality while you sell your business, review the guidance at Sunbelt Business Brokers.

Thoughtful tax planning protects the value you have built. By clarifying deal structure, modeling recapture, coordinating state rules, and documenting expenses, owners improve net proceeds and reduce surprises at closing. Early collaboration with a seasoned broker and tax advisor helps you navigate decisions confidently and finish your sale on stronger financial footing.

How to Choose the Right Business Broker in South Florida

If you want to sell your business, start with confidential broker guidance. Choosing a business broker is one of the most important steps when selling a business. The right broker can streamline the process, connect you with serious buyers, and secure a fair price. In South Florida’s competitive market, owners should carefully evaluate their options before deciding.

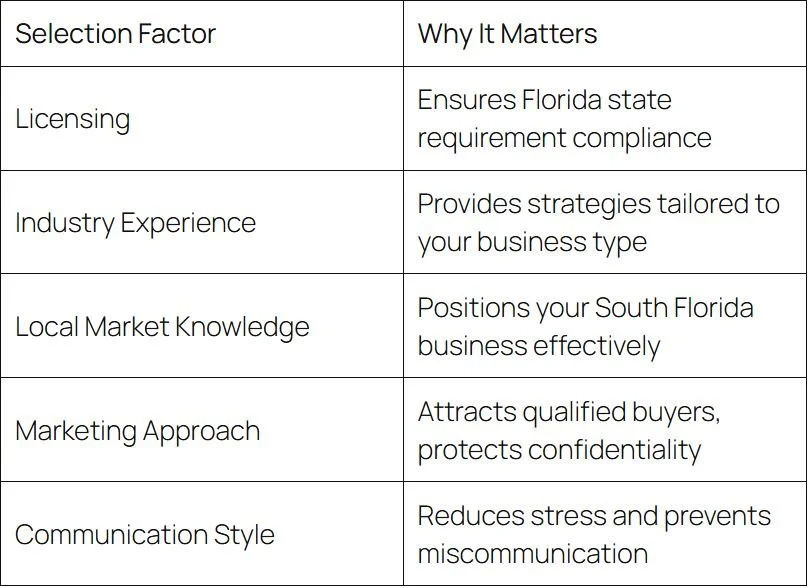

Check Licensing and Experience

Florida requires brokers to hold a real estate license. Beyond licensing, look for years of experience specifically in business transfers. A broker who has closed multiple deals in your industry or size range will bring proven strategies and market knowledge. Asking about deal volume and average closing times provides insight into how efficiently they work. Similarly, talking to a potential business broker will help you become familiar with the process.

Evaluate Local Market Knowledge

South Florida’s business climate is unique, with tourism, healthcare, and service industries driving much of the economy. A broker who understands regional trends can position your business effectively and attract the right buyers. Local insight is especially valuable in areas with strong seasonal activity, where timing a sale can influence valuation and buyer competition.

Ask About Marketing Strategies

Successful sales depend on how businesses are presented. Brokers will offer customized marketing that highlights financial strengths, industry potential, and growth opportunities while maintaining confidentiality. A strong plan attracts qualified buyers quickly and protects sensitive details. Proactive marketing demonstrates a broker’s ability to generate buyer interest rather than waiting for inquiries.

Key Factors in Broker Selection

Choosing a business broker is not as simple as choosing the first option in a search result. The wrong choice can cost months and reduce buyer confidence, while the right one builds trust and maximizes value. Do your due diligence, getting familiar with what is involved when you hire a business broker. Use these criteria when evaluating candidates:

Confirm an active Florida real estate license

Look for successful deals in your industry

Ask about regional expertise in South Florida markets

Review their marketing and buyer outreach process

Request references from past clients

Broker Qualities That Matter

Assess Communication and Support

Selling a business is a months-long process that requires clear communication. A broker who provides regular updates and explains each stage reduces stress and builds confidence. They should coordinate with your legal and financial advisors to ensure a smooth transition. Responsiveness can prevent missed opportunities and protect transaction value.

Choosing the right business broker in South Florida means balancing credentials, experience, local knowledge, and communication style. Owners who do their homework are more likely to achieve a smooth sale and maximize value.

5 Important Valuation Tips Small Business Owners Really Need

Understanding what your business is worth is a roadmap for future decisions. Whether you’re planning to sell, attract investors, or simply want clarity, valuation provides the foundation. But where do you begin? Here are five key tips every small business owner should know when preparing for an accurate, useful valuation.

Know the Common Valuation Methods

Not all valuations are alike. The most common methods include discounted cash flow (DCF), which projects future earnings; comparable company analysis, which benchmarks against recent sales in your industry; and asset-based approaches, which tally assets minus liabilities. Each method has strengths depending on whether your business is cash-flow stable, industry-aligned, or asset-heavy.

Keep Clean and Consistent Financial Records

Valuations are only as reliable as the data behind them. Organized statements of income, expenses, and balance sheets show a clear picture of financial health. Buyers often discount businesses with messy or incomplete books. Clean records also make it easier to highlight growth trends and reassure lenders or investors.

Understand Market Multiples

Many small businesses are valued at two to four times seller’s discretionary earnings (SDE), according to industry research. That means a business generating $500,000 in SDE could be valued between $1 million and $2 million, depending on growth potential, location, and industry risk. Knowing these benchmarks prevents overpricing and keeps expectations realistic.

Factor in Intangibles Beyond the Numbers

Brand reputation, customer loyalty, intellectual property, and contracts all add value. Imagine two businesses with identical financials: one has a loyal customer base and strong online reviews, while the other has no digital presence. The first will likely command a higher valuation even if the earnings look the same on paper.

Get Professional Help from a Business Broker

Valuing your own business can be risky. A professional broker brings objective insight, access to databases of comparable sales, and experience navigating buyer expectations. Their perspective often uncovers strengths you may overlook and helps position your business for a better sales outcome.

Quick Checklist

Before moving forward with a valuation, make sure you:

Gather clean, up-to-date financial statements

Review comparable business sales in your industry

Understand valuation multiples (e.g., SDE, EBITDA)

Consider intangible assets like customer loyalty

Consult a professional broker for guidance

Business Valuation FAQ

Q: How often should I update my business valuation?

A: Experts recommend updating at least every two to three years, or sooner if you’re considering selling or experiencing significant growth.

Q: Does a higher valuation always mean better results?

A: Not necessarily. Overpricing a business can drive buyers away. The best valuations strike a balance between market data and realistic expectations.

Knowing your business’s value puts you in control. With the right methods, accurate records, awareness of benchmarks, and professional input, small business owners can plan strategically and maximize returns.

How Do Business Brokers Protect Confidentiality During a Sale?

If you’re getting ready to sell your business, you might already know that business brokers can increase your chances of a profitable sale. But did you know your broker can protect your confidentiality, too?

If customers, employees, and suppliers find out that your company is for sale, it can seriously disrupt operations and ultimately lower your business’s value. This is the last thing you need when you’re trying to sell.

Here are some of the most important ways a business broker can protect your confidentiality.

Targeted Marketing Efforts

Business brokers often maintain networks of interested buyers. When they have a new business for sale, they may reach out to individual buyers who may see the company as a suitable investment.

Over the course of this kind of targeted marketing, your business broker won’t reveal your company’s name or identifying details. This group of buyers is thoroughly screened and pre-vetted, so the only people made aware of the sale are those who are financially capable and serious about making a purchase.

Tiered Information Release

When you list a home or a car for sale, you generally want to include as much information as you reasonably can. The same can’t be said for marketing a business.

To protect your privacy and minimize the risk of business disruption, your business broker will usually release information gradually. Here’s an example of how this process may work:

A broker offers a “blind teaser” to generate interest among potential buyers

After signing a confidentiality agreement, an interested buyer may learn the company name and other details

Once in the due diligence phase, a buyer may view complete records

Because sensitive business information is only available on a need-to-know basis, this strategy greatly reduces the risk of a breach of confidentiality.

Non-Disclosure Agreements (NDAs)

Sometimes, a potential buyer will consider your business long enough to learn sensitive details. To prevent would-be buyers from leaking information, business brokers often make use of NDAs.

Some people might believe that an NDA is little more than a piece of paper, but this isn’t true. NDAs are legally actionable, and if your business suffers financial losses because a potential buyer shared protected information, you may sue for damages.

Data Security

Business brokers often use secure communication channels to shield information from unauthorized third parties. If a potential buyer is granted access to financial documents, they may only be allowed to view them in secure, encrypted data rooms.

Balancing Your Privacy With a Buyer’s Right to Know

When you put your business on the market, you don’t want everyone to know. However, if you don’t give interested buyers enough information, they may become frustrated and look elsewhere.

Fortunately, when you sell your business with the help of a business broker, you don’t have to strike this balance yourself. Brokers understand how to effectively market a company while still protecting the owner’s privacy. When you have the help of an experienced broker, you’re far more likely to make an efficient and profitable sale.

How Business Brokers Protect Your Confidential Information

When it comes time to sell your business, you want qualified buyers to know — but you don’t want to announce the sale for the entire world to hear. Fortunately, business brokers are skilled in the art of shielding confidential information while still effectively marketing your company.

Here’s a look at some of the most important ways your business broker can protect your confidential information.

Using Blind Listings

If customers, employees, or suppliers learn that your company is for sale, your business could be disrupted. Customers may turn to competitors, employees may panic and look for employment elsewhere, and suppliers may start to worry about losing their business relationship with you.

All of these scenarios can cause a business’s value to drop, and that’s the last thing you need when your business is for sale. That’s why business brokers use “blind” listings. These listings include key financial information and a general description of the company, but they don’t list it by name.

Vetting Buyers Thoroughly

Your business broker won’t give information about your company to just anyone. Before setting up a meeting or revealing additional details about your business, your broker will look closely at a potential buyer.

Specifically, they’ll verify that the buyer has the financial means to make the purchase and that they’re serious about buying the company. Many brokers maintain existing networks of qualified buyers. This way, they may be able to find a purchaser without having to market your company extensively.

Signing Non-Disclosure Agreements (NDAs)

Once a buyer has been vetted, they don’t immediately receive all of the relevant information about your business. Before revealing sensitive information, your broker will typically ask the buyer to sign an NDA.

This contract prohibits the buyer from sharing any confidential information they’ve learned. NDAs are legally enforceable, so you’ll have recourse if a potential buyer breaks confidentiality.

For example, if a potential buyer shares your company’s identity on social media and you lose money as a result, you may be able to sue for damages.

Serving as an Intermediary

Generally, all communications between you and a potential buyer go through your broker. This saves you from the headache of constant communication with would-be buyers. More importantly, it stops buyers from prematurely identifying your business and possibly contacting employees or suppliers.

Emphasizing Data Security

If unauthorized third parties gain access to your business broker’s files, they may discover sensitive information about your company. To reduce the risk of a data breach, business brokers typically rely on cybersecurity measures like these:

Data encryption

Secure networks

Secure file-sharing tools and other communication channels

Virtual data rooms (VDRs)

Because maintaining data security is a continuous process, most business brokers regularly update their systems to address potential vulnerabilities.

Your Information Is Safe With Your Broker

When you sell your business, you and your broker are on the same team. Business brokers understand how devastating leaks can be to a sale and to your company as a whole, and they have the necessary tools to protect your confidential information.

Selling your company can be stressful, especially when the current operations of your business are on the line. But when you work with a broker, you can ensure your information is in good hands.

Steps to Take Before Listing Your Business for Sale

If you’ve decided to sell your business, you might already be looking forward to what you’ll do after the sale is complete. However, the decision to sell is just the beginning.

If you want to maximize your profits and avoid potential pitfalls, it’s essential to take a few key steps before putting your company on the market. Here’s a closer look.

Get an Accurate Business Valuation

You might already have a general idea of what your business is worth, and online calculators can give you a rough estimate. However, if you’re selling your company, you need an in-depth, expert business valuation. If you don’t know how much your company is worth, you could unwittingly shortchange yourself.

Business brokers often perform business valuations themselves or work with certified business appraisers. If you don’t have a recent business valuation, your broker should be able to help you get one.

Gather and Organize Financial Records

When a buyer is considering purchasing your business, one of the first things they’ll look at is your financial records. These are some of the most important metrics for potential buyers:

Revenue over time and current revenue trends

Cash flow

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

Gross margin (funds remaining after direct costs are paid)

Net profit margin (funds remaining after all expenses have been paid)

Having well-organized financials can help reduce the stress that comes with selling your company. If a buyer asks to see financials and receives incomplete or disorganized documentation, they may be concerned that the rest of your company is disorganized, too.

Assemble Your Team

Selling your business is a major undertaking. Before you begin, it’s wise to assemble the right support team. Many business owners choose to hire the following people before they sell:

A business broker

An attorney

A CPA or other tax professional

A wealth manager

You might think that paying for attorneys, tax professionals, and wealth managers is unnecessary — even a waste of money. However, hiring them will often save you money in the long run.

Attorneys can prevent costly legal problems, and the right tax professional can help you avoid getting into trouble with the IRS. The right wealth manager can help you strategically invest the proceeds to get the most out of your money.

Take Steps to Improve Profitability

It’s never a bad thing to improve a business’s profitability. However, doing so right before a sale is particularly important. Potential buyers are willing to pay more for highly profitable businesses, especially if their profitability is trending upward.

Don’t Be Intimidated by the Sales Process

The process of selling a business is complex. Fortunately, you don’t have to handle the sale alone. Business brokers don’t just step in when it’s time to market your company — they can also guide you through the pre-sale steps you need to take.

It might be tempting to try to sell your business quickly. But when you take the time to prepare, you’ll likely be rewarded with better profits and a smoother experience overall.

When to Start Planning Your Business Exit

Deciding when to exit your business is one of the most pivotal moments in your entrepreneurial journey. Whether you’re driven by retirement goals, a desire to try something new, or changing market conditions, the timing and strategy behind your exit can dramatically impact your personal finances and the future of the business. Many owners wait too long, only to find themselves rushed and unprepared. In reality, the best time to start planning your business exit is well before you’re ready to leave.

Years in Advance, Not Months

Ideally, exit planning should begin three to five years before you intend to sell or transition ownership. That window allows time to clean up financials, improve operational efficiencies, and boost profitability. It also gives you the opportunity to put systems in place that allow the business to run independently of your daily involvement. Buyers want to see a strong foundation that won’t crumble once the original owner steps away.

This level of preparation isn’t something you can accomplish in a few weeks. Business valuation alone can involve months of reviewing records, identifying risks, and assessing market positioning. Starting early gives you more control, more options, and more leverage in negotiations.

Responding to Life and Market Conditions

Sometimes the decision to exit isn’t based on a timeline. Health issues, family obligations, or unexpected economic shifts can force the issue. Planning early ensures that if circumstances change suddenly, you’re not left scrambling. A business that is already set up for a smooth handoff will hold its value better in a time-sensitive sale.

Market cycles also influence the optimal time to sell. A strong economy or increased demand for businesses in your sector could drive interest and competitive offers. On the other hand, if the industry is slowing, it may be smart to plan ahead and look for the right window before valuations begin to drop.

Personal and Financial Readiness

A proper exit plan also factors in your personal goals. What do you want your life to look like after you leave the business? Will you need income from the sale to support retirement or other ventures? Starting early gives you time to align your business exit with your financial future, including tax strategies, estate planning, and long-term investment shifts.

Exiting a business can also stir up unexpected emotions. For many owners, their company is a core part of their identity. Thinking about the transition ahead of time helps you mentally prepare for that shift, making it easier to step away without regret.

Work With the Right Professionals

Business brokers, financial advisors, and legal experts play a key role in exit planning. They help you structure the process, value the business correctly, and screen potential buyers. Engaging with these professionals early in your timeline ensures your exit is thoughtful, well-coordinated, and positioned for success.

Protecting Intellectual Property During Business Sales

When selling a business, most owners focus on tangible assets like equipment, inventory, or real estate. But for many businesses, the most valuable assets are intangible—your intellectual property (IP). Whether it’s a trademarked brand, proprietary software, customer databases, or trade secrets, your IP can be a major driver of your company’s valuation. That’s why protecting it throughout the business sale process is essential.

Identify and Document All Intellectual Property Assets

Before entering any discussions with potential buyers, create a clear inventory of your intellectual property. This includes:

Registered trademarks, service marks, or logos

Copyrighted materials (manuals, content, designs)

Patents or patent applications

Proprietary software or technology

Client lists or CRMs

Business processes, formulas, or trade secrets

Buyers will want to see these assets well-documented. If you can’t clearly identify and prove ownership of your IP, it may devalue your business—or raise red flags that stall the sale.

Ensure Ownership Is Legally Transferred and Protected

Ownership isn’t just about who uses the asset—it’s about who legally holds the rights. Make sure any IP created by employees, contractors, or vendors is clearly assigned to the business in writing. Review employment agreements and vendor contracts to ensure they include “work for hire” clauses and IP assignment provisions.

Without clear legal ownership, you can’t transfer those rights to a buyer, and that could unravel the deal during due diligence.

Use Non-Disclosure Agreements Early and Often

Before sharing any proprietary information, require potential buyers to sign a non-disclosure agreement (NDA). This protects you from having your intellectual property leaked, copied, or used against you—even if the deal doesn’t close.

An NDA should cover more than just financial statements. Include language that protects product formulas, customer lists, marketing strategies, software code, and any other sensitive information tied to your operations.

Control Access to Sensitive Information

It’s tempting to be transparent with an eager buyer, but over-sharing too soon can backfire. Use a staged approach to disclosure. At early stages, keep discussions general. As buyers become more serious and complete key milestones—like signing an NDA or showing proof of funds—you can grant controlled access to more detailed materials, often through a secure data room.

A business broker can help manage this process, ensuring confidentiality is maintained while still giving buyers what they need to move forward.

Include Clear IP Terms in the Purchase Agreement

Once you’re ready to finalize the sale, make sure the purchase agreement clearly outlines which intellectual property assets are being transferred. Spell out what’s included, what’s excluded, and how the handoff will occur.

Work with a legal advisor to ensure all IP filings are updated with the buyer’s information after closing. Trademarks, copyrights, and patents often require formal assignments or filings with federal agencies to make the transfer official.

Failing to properly transfer IP can result in disputes or missed protections for both parties. A clean transition ensures the buyer gets full value—and you avoid headaches down the road.

How to Pre-Qualify Buyers Before Listing Your Business

When you’re preparing to sell your business, one of the most important—yet often overlooked—steps is pre-qualifying potential buyers. While it’s easy to get excited by early interest, not every inquiry is worth your time. Some buyers may lack the financial means, industry experience, or genuine intent to follow through. Pre-qualifying buyers before listing your business can help you focus on serious prospects and avoid costly delays or failed deals.

Understand What Makes a Qualified Buyer

Not all buyers are created equal. Some may be well-funded investors, others may be competitors, and a few might just be curious entrepreneurs. A qualified buyer typically checks three boxes: financial capability, operational readiness, and strategic alignment.

Financial capability means they can access the funds needed to make the purchase—either through personal capital, bank loans, or investor backing. Operational readiness refers to their ability to take over management and continue the success of the business. Strategic alignment means the business fits their goals and expertise.

Ask the Right Questions Early On

When interest first comes in, it’s easy to want to move quickly. But a few strategic questions up front can filter out unqualified buyers. Consider asking:

What is your background in this industry?

How do you plan to finance the purchase?

Are you looking to be an owner-operator or hire management?

What attracts you to this specific business?

The answers will tell you a lot about their seriousness, experience, and how realistic they are about ownership.

Review Proof of Funds

A buyer might sound great on paper, but unless they can provide proof of funds or a pre-qualification letter from a lender, you could be wasting your time. Requiring financial documentation is a professional and necessary part of the process. It’s not about being intrusive—it’s about protecting your time, your staff, and your business reputation.

Working with a business broker ensures this step is handled discreetly and professionally, without turning away the right candidates.

Protect Confidentiality with a Non-Disclosure Agreement (NDA)

Before sharing detailed financials or proprietary information, have every buyer sign a legally binding non-disclosure agreement. This protects your business in case the deal doesn’t go through, and also weeds out casual browsers who aren’t ready to commit to the process.

A signed NDA also sets the tone: this is a serious process, and you expect buyers to treat it with professionalism and respect.

Work With a Broker to Qualify Buyers Before You Ever List

One of the biggest advantages of working with a business broker is that they often pre-qualify buyers before your business even goes on the market. Brokers have relationships with active, qualified buyers and know how to match your business with the right fit.

They also understand how to evaluate financials, read between the lines during conversations, and guide buyers through the pre-approval process—so you spend your time talking to serious prospects, not tire-kickers.

Understanding the Tax Implications When You Sell Your Business

Building a successful business takes hard work, and you want to get the maximum benefit when you’re ready to sell. Understanding the tax implications of a business sale can help you do that.

You can get hit by a few taxes depending on the type of sale, the ownership structure of your business, and your financial circumstances. However, the capital gains tax is the primary tax of concern.

How a Capital Gains Tax Impacts Selling Your Business

When you sell an asset, you pay a capital gains tax on the profit of the sale. A business is no different. When you sell your business, you may have to pay capital gains taxes if you show a profit from the difference between the sale price and the basis, or what you paid to acquire and improve your company.

Your capital gain could be huge, so the consideration you give to taxes can significantly impact how much money you walk away with. If you have owned your business for less than a year and sell, the short-term capital gain is taxed as regular income. A business owned longer than a year and sold is taxed as a long-term capital gain with tax rates of 0 percent, 15 percent, and 20 percent, depending on your income and filing status.

If your basis was $100,000 to start your business and you owned it for five years, a sale for $5 million would give you a capital gain of $4.9 million. At a capital gains tax rate of 20 percent, you would pocket $3.92 million.

Depending on where you live, you might also have to pay a state income tax. Business brokers can pull together a team of professionals, including a tax accountant, to build tax strategies to help you mitigate taxes from selling your business.

The Structure of Your Business Matters

The business structure you have impacts how taxes are paid. Your business might have one of the following structures:

Limited Liability Company (LLC)

Partnership

S Corporation

C Corporation

Taxes are a pass-through for the owners of LLCs, partnerships, and S corporations. That means you pay the taxes from the sale of a business. However, taxes on the sale of a C corporation get more complicated.

The Type of Sale

Selling your business can happen in two ways: an asset sale or a stock sale. As an LLC, partnership, or S corporation, you typically will not incur additional taxes on the sale of assets. However, when selling assets as a C corporation, you could be taxed twice — at the corporate and shareholder levels.

You can avoid that by selling the stock of the company. However, most buyers prefer to buy assets because they can deduct the cost of buying your company.

Tax Considerations Before You Sell Your Business

The terms of your deal can also determine the taxes you pay.

Cash at Closing: You receive cash at closing

Earn Out: The buyer pays some cash at closing, but the rest over time

Equity Rollover: You receive cash for some stock, but hold on to some

Seller’s Note: You allow the buyer to pay over time with interest

Taking cash at closing gives you the biggest capital gains tax hit, although your risk increases with the other terms.

Plan for Taxes Before You Sell

To keep as much of your business sale proceeds as possible, consider adding tax planning long before you sell your business. Business brokers can guide you in preparing for the tax implications of selling your business.

How to Determine the Value of Your Business

Whether you’re trying to attract investors or sell your business, knowing the value of your business is critical to its success. However, many small and medium business owners admit to not knowing the value of their enterprise.

Running your business without knowing its true worth can leave you at a disadvantage when someone inquires about buying your business. It can also cause you to miss out on growth opportunities.

For business owners, it can be easy to get caught up in day-to-day operations or simply not want to pay for a business valuation. However, working with business brokers can deliver a business valuation to help you get the most out of your business now and in the future.

What Is a Business Valuation?

A business valuation is the process of determining the economic worth of a company. It evaluates such key factors as financial performance, tangible and intangible assets, growth potential, and market conditions.

When selling your business, a proper business valuation can ensure you’re not leaving money on the table or you don’t have an overblown idea of your company’s value. Understanding how much your business is worth can also help you target growth, land a bank loan, attract investors, or plan your exit.

3 Common Types of Business Valuations

Every business is different, and you can — and should — evaluate a business in many ways. Taking different approaches to how much your business is worth can provide you with a range of its true value and demonstrate to others that you’ve done your homework.

Here are three common types of business valuations:

1. Asset-Based

Consider this approach if your business has significant assets. Total your tangible assets (property, machinery, and inventory) and intangible assets (brand, customer loyalty, goodwill, and patents), and subtract your liabilities.

2. Market-Based

This method compares your business to other businesses of comparable size, performance, and industry that have recently been sold.

3. Income-Based

If your business has strong potential for growth, an income-based valuation might be best. It focuses on the business’s ability to generate profits in the future. You can use a capitalization factor to project potential profits based on past earnings or determine a value based on discounted future earnings.

Earnings multiples is another common approach that applies a multiple to earnings, such as net income or EBITDA (earnings before interest, taxes, depreciation, and amortization). Other key factors include growth potential, your management team, and industry trends.

How to Value Your Business

Consider these steps to arrive at a sound business valuation:

Determine the reason for the valuation

Gather your financial records

Pick your valuation methods

Apply the methods

Consider key factors of your business

Compare the results of the valuation methods

Business brokers with deep and broad knowledge and experience in small and medium businesses can help you arrive at a proper valuation for your business.

A Business Valuation Is Critical to Your Business

Whether you want to sell your business, find investors, or improve your operations, knowing the true worth of your business is as crucial to its success as staying on top of the day-to-day operations.

Partner With Leading Business Brokers for Successful Sales

When the owner of a small to medium-sized business decides it’s time to sell, many factors and conditions come into play. Navigating through all the ins and outs of a deal requires a dependable support team.

That’s where business brokers come in. They facilitate the details to make sure both sides of the transaction get a fair deal. Here’s what business brokers oversee and how they can help.

Experienced Intermediaries

Business brokers are facilitators and negotiators in the sale of businesses. They play several roles throughout the process: evaluating the business, planning marketing efforts, finding potential buyers, and finalizing sale terms.

Business brokers provide valuable expertise in selling your business. They prepare legal paperwork, outline tax implications, manage regulatory compliance, and build extensive networks. They can even recommend and initiate alternative financing options to complete sales.

Without a business broker for a partner, the owner must take over all the details of selling their business. That’s a major time investment on top of routine business responsibilities. The owner might overlook or misunderstand the finer steps in business valuation, marketing, and negotiations. With a business broker in your corner, you can feel assured no detail is passed over.

Benefits of Using a Business Broker

Using a business broker for selling your business brings some built-in advantages.

Expertise and Experience

Business brokers have specialized knowledge in their field — navigating complex business sales is their full-time job. The best of them have successful track records in structuring deals that benefit both buyers and sellers.

Saved Time

Even when a business owner decides to sell, they still have work responsibilities to fulfill: keeping their business operational, managing employees, and meeting other obligations. A business broker handles much of the transaction process, leaving the owner time to keep the business running.

Access to Buyer Networks

Business brokers stay connected to extensive networks of credible buyers and sellers they’ve worked with. This makes the process of finding a potential buyer much more streamlined.

Maximized Value

Even if you know how much you’ve spent to get and build your business, a broker can find unexpected areas that can add to its total value. A business broker can also suggest ways to grow value even if your business is already on the market.

What to Look For in a Business Broker

If you’re gearing up to sell your business, here are a few characteristics that make a business brokerage a solid transactional partner:

A long track record of success with buyers and sellers

A strong reputation of trust in the business community

Specialized experience in your particular industry

Strong skills in communication, transparency, and ethics

Proven ability to manage complex and fluid transactions

Talk to others in your local or regional business community who have worked with business brokers to find one who will work for you.

Make a Difference With the Right Partner

Business brokers may do all their work behind the scenes, but their responsibilities are crucial. The right one can help you move on to your next chapter after a smooth, successful sale.

Why Do Business Brokers Compare Different Businesses When Selling?

Business brokers are integral to the process of selling a business. They actively seek the right buyer in a marketplace crowded with contenders. One of their primary responsibilities is comparing similar companies to better estimate the true value of the assets they sell.

The comparison process is a key task in selling a business. It’s important to determine the business’s positioning in the marketplace and assess its value. When business brokers have comparable companies to evaluate, they can calculate a fair and reasonable value for the business they’re selling. Doing so can make the transaction smooth and equitable.

Understanding Business Value

Business brokers are experts in analyzing all aspects of the businesses they represent. In comparing similar businesses, they get a better picture of their financial performance, position in the current marketplace, and growth potential. This analysis is especially useful when they have several comparable businesses in the same general area to measure against.

By comparing multiple sale prices and value estimates, business brokers are better able to set the right price for the businesses they represent and find willing buyers.

Monitoring Market Conditions and Buyer Sentiment

The business marketplace is always in flux. Business brokers weigh various businesses’ values against the general condition of the marketplace, including common trends and expectations. Knowing the business landscape as well as they do, business brokers compare businesses so they can make proper adjustments to pricing and marketing the business.

Comparing properties gives brokers the ability to recommend the best positioning and strategies for selling a business. They can strengthen the business’s bottom line and increase the chances of a successful transaction.

Positioning Businesses for Success

Business brokers are tasked with putting companies in the best position for a sale. That often means making adjustments and optimizing current operations to be more attractive to potential buyers.

By comparing a business’s operations to other similar firms, business brokers can identify the positives of the company along with areas for improvement. This gives them the ability to establish successful models or highlight some of the unique traits of the business they’re selling.

Establishing a Fair Selling Price

Perhaps the biggest reason business brokers use comparisons is to set a competitive price for the business being sold. Comparing a business to others can give brokers a better sense of how the company measures up in price and market appeal. In turn, they can set a price that maximizes the company’s value while staying within market expectations.

Using comparisons to set a price can increase the chances of a timely and successful sale while getting the seller the best return possible.

Building Trust and Transparency

Finally, business brokers who present comparisons to their clients reinforce their credibility and trust. They prove their knowledge of the marketplace and research expertise, which resounds with both current clients and potential new ones. They earn a reputation for accuracy, forthrightness, and depth of knowledge.

Comparing businesses is the most direct and effective way for business brokers to arrive at a fair value for the companies they represent.

What Business Brokers Do to Close Deals Quickly

Whether you’re buying or selling a business, getting the deal closed is the ultimate goal. But the path to closing a deal quickly can be littered with obstacles and delays if you don’t have business brokers on your side.

Good business brokers who can get you to closing quickly at the price you want must master several skills to pull off such a feat.

Here’s a look at what business brokers do to close deals quickly.

What Is a Business Broker?

A business broker is someone who can help you buy or sell your small or medium business. A business broker typically has deep knowledge about businesses and experience buying and selling them.

Business brokers take care of many tasks, including:

Determining how much your business is worth

Marketing your business

Screening potential buyers

Negotiating deals

Managing the due diligence process

Business brokers who have honed these skills can close deals quickly.

How Business Brokers Close Deals Quickly

Business brokers who can get you to closing quickly must display their full set of skills honed over the years. They must efficiently match a buyer to a seller, stay ahead of any potential issues, analyze the market, communicate openly and often, deploy advanced negotiation techniques, and promptly prepare all documentation.

Here are the steps business brokers follow to close deals fast:

Qualify Buyers

To avoid wasting time with unqualified leads, business brokers thoroughly screen buyers to match them to a seller.

Develop a Business Presentation

Business brokers create a comprehensive business profile with accurate financial data, key operational details to help potential buyers understand the business without giving away the name, and a narrative that highlights what makes the business stand out in its industry.

Market the Business

Business brokers develop marketing materials and target their marketing through online listings and their vast industry network.

Communicate Clearly and Often

Business brokers must develop a high level of communication to keep buyers and sellers up to date, appropriately relay wishes between the parties, and promptly resolve any issues that arise.

Negotiate Strategically

One of the most valued skills business brokers have is an advanced negotiation technique. A business broker’s strategic negotiating skills can keep a business deal from falling apart or a business owner from losing out on the full value of a business. Negotiation skills can bridge the gap between the buyer’s and the seller’s expectations and help maintain a positive relationship.

Facilitate Due Diligence

Business brokers can avoid delays by making sure the due diligence process runs smoothly. They can organize financial and legal documents and facilitate the creation of other required documents from attorneys and other professionals.

With their finger on the pulse of industries and markets, business brokers understand how to create a sense of urgency to expedite the process.

Business Brokers Help Your Business Get Sold

Business brokers don’t simply follow a checklist when brokering the sale or purchase of a business. They must master the skills of communication, negotiation, emotional intelligence, adaptability, and market analysis to close deals quickly.

The Secrets of Successful Business Negotiations Revealed

When you begin thinking about selling your business, consider there is way more to the process than finding the right buyer and upfront price. You want to get the best deal, and business brokers can help you uncover the secrets to winning negotiations.

Negotiating is a skilled process that uses a collaborative approach to reach a win-win outcome for you and your buyer. Effectively negotiating your deal can be the difference between walking away with a satisfactory deal or a great deal.

Business brokers have deep knowledge about businesses and years of experience negotiating deals that get you to the closing table faster and at the price you want.

Here are the secrets to successful business negotiations.

What Is a Business Negotiation?

A business negotiation is a process where you and one or more parties are trying to agree on terms of a deal, such as selling your business. The preferable outcome is for the agreement to be mutually beneficial to you and your buyer.

The Secrets Business Brokers Use to Negotiate

Getting to a favorable agreement for both sides requires communication, compromise, and understanding of what each of you wants. The key elements of negotiating a deal that business brokers can help you with include:

Being prepared

Understanding what your buyer wants

Keying on finding mutual ground

Listening intently

Building rapport

Having a best alternative to a negotiated agreement (BATNA)

Staying flexible

Presenting more than one option

Managing your emotions

What holds all this together for you is understanding the value of your business. Business brokers can handle business valuation from beginning to end and can help guide you to finding value in your company.

Start Working With Business Brokers Early to Value Your Company

Analyze your financial statements, such as your profit and loss statement, balance sheet, and cash flow statement. Review projections for future profits and your business plan.

Gauging the value of your business before going into negotiating gives you the best chance of understanding what you should get out of the deal and helps you learn what your buyer needs.

Key Elements of a Successful Negotiation

Knowing the value of your business can prepare you to stick to your key points, communicate, manage your time, make concessions, and be prepared to walk away if necessary. Consider these key steps:

Understand Your Goals and Priorities

Outline what you want to accomplish and what you’re willing to compromise on.

Research Your Buyer

Know what the buyer is looking for and be prepared to meet that need.

Prepare a Plan B

This is your BATNA. Knowing you have an alternative gives you leverage.

Stay Focused on Your Interests

Try to understand the buyer’s demands, consider options, and adapt your position to seek out solutions.

Think Long Term

You want to arrive at the best deal possible, but consider the possibility that you may have future interactions with your buyer.

Taking on experienced business brokers can prepare you to negotiate a great deal for selling your business or to walk away and prepare for the next deal.

Business Brokers Bring Value to Negotiations

Good business brokers have negotiated hundreds of deals and understand businesses across many industries. Pulling business brokers into your team early — when you first begin thinking about selling — can add value to your negotiations to get you the deal you want at the price you want.

What Every Seller Should Know About Business Valuation

Working day in and day out in your business, you probably assume you know everything there is to know about it, including how much your business is worth. However, a M&T Bank survey in 2022 found that 98% of business owners didn’t know the value of their business.

There are many reasons to know how much your business is worth. You may want to buy out a business partner. You also can use a valuation to help guide the strategic planning for your business. Most often, business owners need to know the value of their business when they’re ready to sell it.

Selling a business is no small matter. There’s a lot to know and a lot to keep track of. Having business brokers by your side long before you plan to sell your company can help you get to closing and get the most out of your business.

When you’re ready to sell, business brokers can help you find the right value for your business. Here’s what you should know about business valuation.

What Is a Business Valuation?

A business valuation is a process used to determine the total value of your company and its assets at a specific time. Through the process, independent appraisers or business brokers qualified to evaluate businesses will assess your business’s assets, cash flow, market position, future earning potential, and comparable businesses in your market.

The business valuation is a price you and a buyer might be able to agree on.

Knowing the worth of your business can help you negotiate the price you want to get when your company sells. It also can help you recognize what buyers might see as valuable or areas you can work on to increase the value of your company.

How Business Brokers Evaluate Your Business

Many approaches can be taken to valuing a company. Here are three main approaches business brokers may use to determine the worth of your company.

Income Approach

This approach determines your company’s worth by calculating the income your business will generate in the future and discounting it back to a present value. This method is useful when you’ve established stable and predictable earnings.

Market Approach

A market approach values your company based on prices of comparable businesses that have sold or the value of similarly situated companies.

Asset Approach

This valuation focuses on the net asset value of your business. With this method, you would subtract all liabilities from your total assets to determine your net asset value. The asset approach is typically used for companies that are underperforming.

To facilitate business brokers valuing your company, you must present profit and loss statements and balance sheets for the last three to five years, licenses, deeds, any tax filings and returns, an overview of your business, and your business plan.

Plan With Business Brokers

To attract the right buyers and arrive at closing with the maximum negotiated price you’re comfortable with, consider getting business brokers on board long before you plan to sell. Business brokers can help you understand business valuation and find value in your company that you might not have known existed.

Great Benefits of Using Business Brokers to Sell Businesses

Whether you’re preparing to sell your first business or your upcoming sale is just the latest of many, selling a company is a time-intensive process that can quickly become overwhelming. However, when you work with a business broker, your broker can save you stress, effort, time, money, and more. Here’s a closer look at some of the key benefits of working with business brokers when making a sale.

1. They Might Already Have a Buyer in Mind

Depending on your industry and your business itself, finding buyers can be a challenge. One of the main draws of business brokers is that they maintain networks of active, interested buyers. This means that once your business goes on the market, your broker can quickly connect you to multiple potentially interested buyers.

2. They Keep Things Confidential

If your employees, clients, or customers learn that you’re selling your business, you might experience significant disruption. Your best employees might worry about losing their jobs and start applying elsewhere, and your customers might turn to competitors instead.

It can take significant time to sell a business, and if your company starts experiencing major issues before you find a buyer, a successful sale can become next to impossible.

However, when you have a business broker, you can avoid letting customers and competitors know you’ll be selling. Brokers can conceal identifying details of your business. Once your broker has verified that a potential buyer is qualified, they can ask the buyer to sign a non-disclosure agreement.

3. They Can Accurately Value Your Business

There’s a lot to consider when you’re preparing to sell a business — so much so that it’s easy to overlook the basics. A successful sale starts with an accurate valuation. Overvaluing your company means you’ll find few, if any, buyers. Undervaluing means you’ll potentially cheat yourself out of tens of thousands of dollars.

Business brokers value businesses on an almost daily basis. And because they’re uniquely attuned to market dynamics, they can help you price your business for a quick sale or advise you to sell later if you want to maximize profit.

4. They Can Handle the Logistics

Selling a business is far more complex than selling a vehicle — or even selling a home. From start to finish, the process is filled with logistical challenges:

Creating a marketing strategy

Communicating with interested buyers

Vetting buyers

Negotiating a deal structure that’s beneficial to both of you

Ensuring all necessary documents are appropriately filed

Addressing the tax implications of a sale

Even if you’ve sold companies before, tackling these challenges while continuing to run your company isn’t an easy feat. Business brokers can give you the peace of mind that comes with knowing that the sale — with all of its intricacies — is in good hands.

Is Working With a Business Broker the Right Choice for You?

Ultimately, whether you decide to work with business brokers or sell your business on your own is up to you. However, if you do choose to work with a broker, you’ll likely find that the sales process becomes smooth and efficient. And most importantly, you’ll have more time to focus on running your business.