How Do Business Brokers Keep Your Business Sale on Track?

Deciding to sell your business is a big step. Between valuation, buyer search, financing, tax questions, and closing paperwork, it’s easy for details to slip and for momentum to stall. Business brokers exist to keep that complex process moving, from your first conversation about value to a completed handoff.

Clarify Your Goals and Timing

Before anything goes on the market, a broker will ask why you want to sell, what you hope to net, and when you would like to exit. The selling process starts with a candid discussion of your goals and expectations, so the rest of the plan is built around what you actually want from the sale. Those answers shape:

Whether you should sell now or wait

How aggressively to price the business

What kinds of buyers (individual, strategic, financial) make sense for your situation

Get a Realistic Valuation and Prepare Your Numbers

Next comes a professional valuation and a review of your financials. During this step, a broker may also flag gaps in your books. This helps you avoid overpricing (which scares buyers away) or underpricing (which leaves money on the table). Sunbelt’s selling tutorial explains how valuation and packaging work together to form a realistic asking range:

Analyze historic and current earnings

Normalize add-backs and one-time expenses

Compare your business to recent market data

Prepare the Business and Documents for Buyers

Once you understand value, brokers help you get the business ready for scrutiny:

Identifying operational issues (owner dependency, process gaps) that should be addressed before listing

Organizing key documents: leases, key contracts, licenses, corporate records

Helping you think through what is included in the sale (assets, inventory, employees, name, etc.)

Market the Business and Screen Buyers

With the groundwork in place, brokers create a confidential marketing plan. Their role here is to:

Write and manage blind listings that protect your identity

Tap buyer databases and networks without broadcasting the sale to staff or competitors

Require non-disclosure agreements (NDAs) before sharing sensitive details

Throughout this stage, they pre-qualify inquiries so you spend time only with serious, financially capable buyers. Sunbelt’s articles on selling with confidence describe how brokers balance broad exposure with strict confidentiality to protect your day-to-day operations while you sell your business.

Manage Offers, Due Diligence, and Closing

Once offers arrive, business brokers keep the deal moving by:

Comparing offers and structures (price, terms, contingencies)

Coordinating with your attorney and CPA on letters of intent and contracts

Keeping communication flowing during due diligence so concerns are addressed early

IRS guidance on closing a business highlights tax filings, employment obligations, and other compliance steps that must be handled as you exit. Brokers help you navigate those requirements in parallel with buyer requests so details don’t derail closing. Throughout these final steps, brokers act as process managers so you can stay focused on running the company until the transaction is complete. Working with a broker team means you’re not trying to manage valuation, preparation, marketing, due diligence, and closing alone. When each step is planned and guided by experienced business brokers, you’re far more likely to keep your business sale on track from first conversation through the final handshake.

5 Ways Clean Financial Records Strengthen Your Florida Business Sale

When you’re getting ready to sell your company, the condition of your financial records can quietly raise or lower your sale price. Clear, organized books make it easier for buyers to trust your numbers, move through due diligence faster, and feel confident about closing. Working with experienced advisors to sell your business helps owners spot gaps long before a buyer starts asking questions.

1. Buyers Can Quickly Understand How Your Business Really Performs

When income statements and balance sheets are clean, buyers can evaluate performance without hunting through conflicting spreadsheets or handwritten notes. That clarity reduces suspicion, shortens negotiations, and keeps more potential buyers engaged with your Florida business. They look closely at:

Trends in monthly and annual revenue

Major expense categories and how they change over time

Owner add-backs such as salary, perks, and one-time costs

2. Valuation Conversations Become Easier and More Credible

Valuation is already a sensitive topic. Disorganized records make it harder to defend your asking price because it’s unclear what the business truly earns. This level of organization gives both you and the buyer more confidence when you talk about value. It also makes it simpler for a broker or valuation professional to benchmark your company against similar Florida businesses.

3. Clean Records Reduce Surprises During Due Diligence

Due diligence is where deals often slow down, when numbers don’t match. Missing bank statements, unexplained cash transactions, or inconsistent inventory counts all create doubt. A practical pre-sale step for many Florida owners is to treat the next 6–12 months like you’re already in due diligence. By addressing issues before the listing goes live, you lower the odds of painful renegotiations later and make it easier for a buyer’s accountant to sign off on the deal.

4. Strong Financials Help You Stand Out in a Competitive Florida Market

Florida’s business market is active across industries like hospitality, healthcare, professional services, and home services. Buyers often compare multiple opportunities at the same time making well-organized financial records a quiet advantage. That perception of lower risk can support stronger offers and smoother negotiations. If you’d like to go deeper on how taxes factor into a sale, resources like 5 Tax Issues Every Owner Must Consider Before Selling can be helpful.

5. Good Records Give You More Options When It’s Time to Sell

Some owners want to exit quickly; others are open to staying on for a transition period or structuring part of the price as future payments. Regardless of your preferred exit path, clean financials give lenders, investors, and buyers more confidence in the numbers behind any financing or earn-out. They also make it easier for an experienced broker to highlight opportunities a new owner could pursue

When your records are organized, you’re in a stronger position to choose the deal structure that fits your long-term goals and to sell your business in a way that supports the next chapter in your life. If looking at your books today raises more questions than answers, that’s a useful signal that it may be time to tighten your financial processes, talk with your tax advisor, and explore whether working with a business broker could help you prepare for a smoother, more confident sale.

How to Prepare Financial Records Before You Sell Your Business

Preparing financial records early is one of the most important steps when you plan to sell your business. Buyers rely on accurate information to evaluate risk, assess earnings, and understand long term performance. Clean documentation also helps business brokers represent your company clearly and prevents delays during negotiations. With organized records, buyers can move through the evaluation process with confidence.

Organize Your Core Financial Statements

Prospective buyers typically request at least three years of financial statements, including income statements, balance sheets, and cash flow reports. These documents should match your tax returns and internal accounting summaries. When records show consistency and accuracy, buyers can analyze performance without unnecessary follow-up questions. A well-prepared financial package helps establish trust and shows that your business operates responsibly.

Review Tax Filings for Accuracy

Tax returns serve as a primary confirmation source for buyers and lenders. Ensuring that internal statements align with filed returns reduces the chance of delays. If discrepancies appear, they should be corrected before listing the business. Buyers may also request proof of payment, submission confirmations, and correspondence with tax authorities. Organizing this information in advance helps keep momentum steady and reduces uncertainty.

Reconcile Accounts and Outstanding Balances

Reconciling bank accounts, credit lines, vendor balances, and customer invoices helps eliminate confusion during evaluation. Unreconciled items can slow down due diligence and raise concerns about bookkeeping practices. A professional business broker can help identify the reconciliations that matter most and recommend how to present them. Clean records show discipline in financial management and support a smoother review process.

Document Owner Adjustments

Many small and mid-sized businesses include expenses that would not continue under a new owner. Documenting these adjustments clearly helps buyers understand the company’s true earnings. Examples may include personal travel, owner benefits, non-recurring expenses, or discretionary spending. Creating a detailed schedule with explanations supports stronger valuation discussions and reduces time spent addressing buyer questions.

Prepare Customer, Vendor, and Contract Information

Revenue stability and supplier relationships influence buyer confidence. Preparing summaries of major customers, recurring contracts, and vendor agreements helps demonstrate predictable performance. Confidential details can remain protected until later stages, but organized summaries show that essential information is maintained carefully. This transparency supports faster early-stage evaluation and shows buyers that the business has structured processes.

Support Due Diligence With Organized Files

Once a letter of intent is signed, buyers begin reviewing detailed records. This may include payroll reports, inventory summaries, lease agreements, and loan documentation. Keep in mind that intellectual property should be protected, and contracts must clearly describe what belongs to the business and what is designated to other parties.

Organizing financial records early improves buyer confidence, strengthens negotiations, and supports a smoother path toward closing. With clear documentation and professional guidance, you help ensure that the transaction proceeds efficiently and with fewer obstacles.

How Long Does It Take to Sell Your Business in Today’s Market?

Many owners want a clear answer about how long it takes to sell your business once the process begins. Although timelines vary, most sales in today’s market take between four and nine months. Companies that prepare early, maintain clean records, and work closely with business brokers usually experience faster progress. Understanding the major stages helps set realistic expectations and supports better planning.

Preparation Before Listing

Preparation often takes several weeks and has a significant impact on the overall timeline. Sellers who gather financial statements, contracts, payroll records, and operational information early reduce the chance of delays. This stage also includes identifying strengths, challenges, and opportunities that buyers will likely evaluate. A professional business broker can review your documentation and advise which items need refinement before marketing begins.

Time on the Market

Once the business is listed, early interest usually arrives within the first few weeks. Serious buyers move through qualification before receiving detailed information. Business brokers confirm financial capacity, review acquisition experience, and ensure that inquiries reflect genuine intent. These steps protect confidentiality and help filter out casual shoppers. Most committed buyers progress from initial outreach to active review within thirty to sixty days.

Buyer Review and Engagement

Qualified buyers complete their first round of evaluation by reviewing high-level summaries, recent financial trends, and operational highlights. This stage often includes questions about staff, customer concentration, and growth opportunities. Businesses with consistent earnings and clear financials tend to attract faster engagement. Market conditions also influence speed. High buyer confidence and strong borrowing conditions often shorten time on the market.

Due Diligence and Negotiation

After signing a letter of intent, buyers begin formal due diligence. This phase generally takes thirty to forty-five days. The timeline depends on the quality of documentation and the responsiveness of both parties. Clean accounting records, updated contracts, and organized files help reduce delays. Negotiations related to closing terms, working capital, and transition support often occur at the same time. Clear communication helps maintain momentum.

Market Factors That Influence Timing

Industry demand, revenue stability, and economic conditions all affect how long the sale may take. Essential services and recurring revenue businesses often move faster because buyers view them as more predictable. Lending conditions and regional buyer activity also contribute to timing.

Tips to Improve Your Timeline

Prepare three years of financial statements before listing.

Maintain accurate bookkeeping and organize operational records.

Respond quickly to buyer questions to maintain engagement.

Review a related off-site article for additional context: https://www.sunbeltbusinessbrokersposts.com/blog/understanding-market-timing

For more information about planning your sale, consult a reliable business broker. Understanding the stages involved and preparing early helps create a smoother process. With the right approach and experienced guidance, you can navigate the market efficiently and work toward a successful transition.

5 Tax Issues Every Owner Must Consider Before Selling

Preparing to sell your business involves more than finding a buyer and agreeing on price. Taxes strongly influence how much of the sale proceeds you retain. Owners who plan early are better positioned to structure deals, time closing, and document expenses in ways that reduce liability while keeping the transaction compliant and on track.

Capital gains versus ordinary income

How proceeds are taxed depends on deal structure and entity type. A stock sale often favors capital gains treatment, while an asset sale can split amounts across ordinary income and capital gains. Allocations to items such as goodwill, inventory, and non-compete agreements change the tax mix. Clarify scenarios with your business brokers before letter-of-intent negotiations begin.

Depreciation recapture on fixed assets

Equipment, vehicles, and other depreciated assets may trigger recapture, which is generally taxed at ordinary income rates up to prior depreciation taken. Sellers who overlook this point can be surprised after closing. Inventory assets are typically ordinary income as well. Model the tax effect of asset classes early so your pricing and net-proceeds expectations remain realistic.

State and local considerations

Rules vary widely by state. Some jurisdictions impose additional taxes, surtaxes, or filing steps that affect timing and cash flow. If your company operates in multiple states, nexus and apportionment can complicate the picture. An experienced business broker and tax professional can synchronize federal and state requirements so your closing checklist is complete.

Timing and installment strategies

When the deal closes can change your bracket and your exposure to net investment income tax. Spreading payments through an installment sale may smooth taxes across years, though risks and interest-charge rules apply. Align the closing window with estimated income, retirement plans, and year-end deadlines to avoid preventable bracket creep and cash-flow stress.

Deductible costs and documentation

Many selling expenses reduce taxable gain, including brokerage commissions, legal fees, quality of earnings work, and marketing. Keep detailed invoices, engagement letters, and the final settlement statement. Good recordkeeping supports deductions and speeds any future questions from authorities.

Practical prep checklist

Begin tax planning months before listing.

Compare stock versus asset structures and model outcomes.

Inventory depreciated assets and estimate potential recapture.

Confirm state filings and payment schedules.

Centralize documentation for all deal costs.

For a deeper understanding of selling-a-business tax topics, a consultation with reputable business brokers is an excellent idea. To understand process steps and confidentiality while you sell your business, review the guidance at Sunbelt Business Brokers.

Thoughtful tax planning protects the value you have built. By clarifying deal structure, modeling recapture, coordinating state rules, and documenting expenses, owners improve net proceeds and reduce surprises at closing. Early collaboration with a seasoned broker and tax advisor helps you navigate decisions confidently and finish your sale on stronger financial footing.

How to Choose the Right Business Broker in South Florida

If you want to sell your business, start with confidential broker guidance. Choosing a business broker is one of the most important steps when selling a business. The right broker can streamline the process, connect you with serious buyers, and secure a fair price. In South Florida’s competitive market, owners should carefully evaluate their options before deciding.

Check Licensing and Experience

Florida requires brokers to hold a real estate license. Beyond licensing, look for years of experience specifically in business transfers. A broker who has closed multiple deals in your industry or size range will bring proven strategies and market knowledge. Asking about deal volume and average closing times provides insight into how efficiently they work. Similarly, talking to a potential business broker will help you become familiar with the process.

Evaluate Local Market Knowledge

South Florida’s business climate is unique, with tourism, healthcare, and service industries driving much of the economy. A broker who understands regional trends can position your business effectively and attract the right buyers. Local insight is especially valuable in areas with strong seasonal activity, where timing a sale can influence valuation and buyer competition.

Ask About Marketing Strategies

Successful sales depend on how businesses are presented. Brokers will offer customized marketing that highlights financial strengths, industry potential, and growth opportunities while maintaining confidentiality. A strong plan attracts qualified buyers quickly and protects sensitive details. Proactive marketing demonstrates a broker’s ability to generate buyer interest rather than waiting for inquiries.

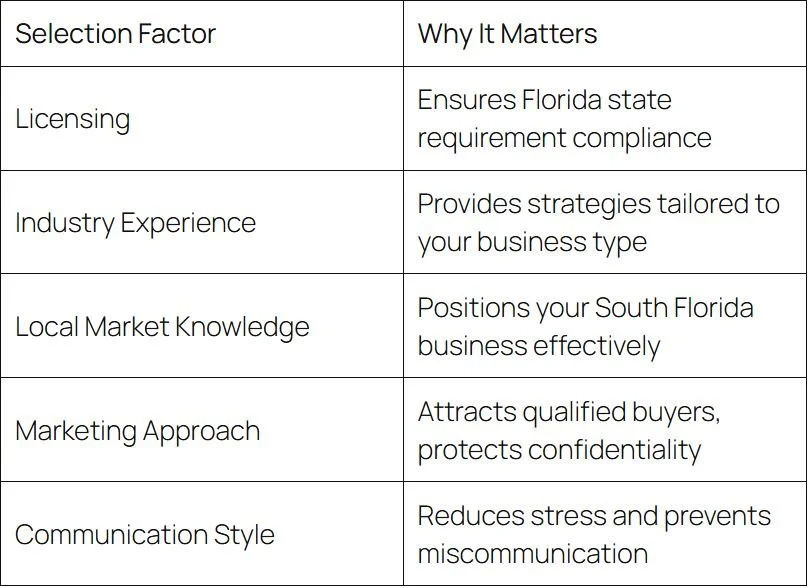

Key Factors in Broker Selection

Choosing a business broker is not as simple as choosing the first option in a search result. The wrong choice can cost months and reduce buyer confidence, while the right one builds trust and maximizes value. Do your due diligence, getting familiar with what is involved when you hire a business broker. Use these criteria when evaluating candidates:

Confirm an active Florida real estate license

Look for successful deals in your industry

Ask about regional expertise in South Florida markets

Review their marketing and buyer outreach process

Request references from past clients

Broker Qualities That Matter

Assess Communication and Support

Selling a business is a months-long process that requires clear communication. A broker who provides regular updates and explains each stage reduces stress and builds confidence. They should coordinate with your legal and financial advisors to ensure a smooth transition. Responsiveness can prevent missed opportunities and protect transaction value.

Choosing the right business broker in South Florida means balancing credentials, experience, local knowledge, and communication style. Owners who do their homework are more likely to achieve a smooth sale and maximize value.

5 Important Valuation Tips Small Business Owners Really Need

Understanding what your business is worth is a roadmap for future decisions. Whether you’re planning to sell, attract investors, or simply want clarity, valuation provides the foundation. But where do you begin? Here are five key tips every small business owner should know when preparing for an accurate, useful valuation.

Know the Common Valuation Methods

Not all valuations are alike. The most common methods include discounted cash flow (DCF), which projects future earnings; comparable company analysis, which benchmarks against recent sales in your industry; and asset-based approaches, which tally assets minus liabilities. Each method has strengths depending on whether your business is cash-flow stable, industry-aligned, or asset-heavy.

Keep Clean and Consistent Financial Records

Valuations are only as reliable as the data behind them. Organized statements of income, expenses, and balance sheets show a clear picture of financial health. Buyers often discount businesses with messy or incomplete books. Clean records also make it easier to highlight growth trends and reassure lenders or investors.

Understand Market Multiples

Many small businesses are valued at two to four times seller’s discretionary earnings (SDE), according to industry research. That means a business generating $500,000 in SDE could be valued between $1 million and $2 million, depending on growth potential, location, and industry risk. Knowing these benchmarks prevents overpricing and keeps expectations realistic.

Factor in Intangibles Beyond the Numbers

Brand reputation, customer loyalty, intellectual property, and contracts all add value. Imagine two businesses with identical financials: one has a loyal customer base and strong online reviews, while the other has no digital presence. The first will likely command a higher valuation even if the earnings look the same on paper.

Get Professional Help from a Business Broker

Valuing your own business can be risky. A professional broker brings objective insight, access to databases of comparable sales, and experience navigating buyer expectations. Their perspective often uncovers strengths you may overlook and helps position your business for a better sales outcome.

Quick Checklist

Before moving forward with a valuation, make sure you:

Gather clean, up-to-date financial statements

Review comparable business sales in your industry

Understand valuation multiples (e.g., SDE, EBITDA)

Consider intangible assets like customer loyalty

Consult a professional broker for guidance

Business Valuation FAQ

Q: How often should I update my business valuation?

A: Experts recommend updating at least every two to three years, or sooner if you’re considering selling or experiencing significant growth.

Q: Does a higher valuation always mean better results?

A: Not necessarily. Overpricing a business can drive buyers away. The best valuations strike a balance between market data and realistic expectations.

Knowing your business’s value puts you in control. With the right methods, accurate records, awareness of benchmarks, and professional input, small business owners can plan strategically and maximize returns.

How Do Business Brokers Protect Confidentiality During a Sale?

If you’re getting ready to sell your business, you might already know that business brokers can increase your chances of a profitable sale. But did you know your broker can protect your confidentiality, too?

If customers, employees, and suppliers find out that your company is for sale, it can seriously disrupt operations and ultimately lower your business’s value. This is the last thing you need when you’re trying to sell.

Here are some of the most important ways a business broker can protect your confidentiality.

Targeted Marketing Efforts

Business brokers often maintain networks of interested buyers. When they have a new business for sale, they may reach out to individual buyers who may see the company as a suitable investment.

Over the course of this kind of targeted marketing, your business broker won’t reveal your company’s name or identifying details. This group of buyers is thoroughly screened and pre-vetted, so the only people made aware of the sale are those who are financially capable and serious about making a purchase.

Tiered Information Release

When you list a home or a car for sale, you generally want to include as much information as you reasonably can. The same can’t be said for marketing a business.

To protect your privacy and minimize the risk of business disruption, your business broker will usually release information gradually. Here’s an example of how this process may work:

A broker offers a “blind teaser” to generate interest among potential buyers

After signing a confidentiality agreement, an interested buyer may learn the company name and other details

Once in the due diligence phase, a buyer may view complete records

Because sensitive business information is only available on a need-to-know basis, this strategy greatly reduces the risk of a breach of confidentiality.

Non-Disclosure Agreements (NDAs)

Sometimes, a potential buyer will consider your business long enough to learn sensitive details. To prevent would-be buyers from leaking information, business brokers often make use of NDAs.

Some people might believe that an NDA is little more than a piece of paper, but this isn’t true. NDAs are legally actionable, and if your business suffers financial losses because a potential buyer shared protected information, you may sue for damages.

Data Security

Business brokers often use secure communication channels to shield information from unauthorized third parties. If a potential buyer is granted access to financial documents, they may only be allowed to view them in secure, encrypted data rooms.

Balancing Your Privacy With a Buyer’s Right to Know

When you put your business on the market, you don’t want everyone to know. However, if you don’t give interested buyers enough information, they may become frustrated and look elsewhere.

Fortunately, when you sell your business with the help of a business broker, you don’t have to strike this balance yourself. Brokers understand how to effectively market a company while still protecting the owner’s privacy. When you have the help of an experienced broker, you’re far more likely to make an efficient and profitable sale.

How Business Brokers Protect Your Confidential Information

When it comes time to sell your business, you want qualified buyers to know — but you don’t want to announce the sale for the entire world to hear. Fortunately, business brokers are skilled in the art of shielding confidential information while still effectively marketing your company.

Here’s a look at some of the most important ways your business broker can protect your confidential information.

Using Blind Listings

If customers, employees, or suppliers learn that your company is for sale, your business could be disrupted. Customers may turn to competitors, employees may panic and look for employment elsewhere, and suppliers may start to worry about losing their business relationship with you.

All of these scenarios can cause a business’s value to drop, and that’s the last thing you need when your business is for sale. That’s why business brokers use “blind” listings. These listings include key financial information and a general description of the company, but they don’t list it by name.

Vetting Buyers Thoroughly

Your business broker won’t give information about your company to just anyone. Before setting up a meeting or revealing additional details about your business, your broker will look closely at a potential buyer.

Specifically, they’ll verify that the buyer has the financial means to make the purchase and that they’re serious about buying the company. Many brokers maintain existing networks of qualified buyers. This way, they may be able to find a purchaser without having to market your company extensively.

Signing Non-Disclosure Agreements (NDAs)

Once a buyer has been vetted, they don’t immediately receive all of the relevant information about your business. Before revealing sensitive information, your broker will typically ask the buyer to sign an NDA.

This contract prohibits the buyer from sharing any confidential information they’ve learned. NDAs are legally enforceable, so you’ll have recourse if a potential buyer breaks confidentiality.

For example, if a potential buyer shares your company’s identity on social media and you lose money as a result, you may be able to sue for damages.

Serving as an Intermediary

Generally, all communications between you and a potential buyer go through your broker. This saves you from the headache of constant communication with would-be buyers. More importantly, it stops buyers from prematurely identifying your business and possibly contacting employees or suppliers.

Emphasizing Data Security

If unauthorized third parties gain access to your business broker’s files, they may discover sensitive information about your company. To reduce the risk of a data breach, business brokers typically rely on cybersecurity measures like these:

Data encryption

Secure networks

Secure file-sharing tools and other communication channels

Virtual data rooms (VDRs)

Because maintaining data security is a continuous process, most business brokers regularly update their systems to address potential vulnerabilities.

Your Information Is Safe With Your Broker

When you sell your business, you and your broker are on the same team. Business brokers understand how devastating leaks can be to a sale and to your company as a whole, and they have the necessary tools to protect your confidential information.

Selling your company can be stressful, especially when the current operations of your business are on the line. But when you work with a broker, you can ensure your information is in good hands.

Steps to Take Before Listing Your Business for Sale

If you’ve decided to sell your business, you might already be looking forward to what you’ll do after the sale is complete. However, the decision to sell is just the beginning.

If you want to maximize your profits and avoid potential pitfalls, it’s essential to take a few key steps before putting your company on the market. Here’s a closer look.

Get an Accurate Business Valuation

You might already have a general idea of what your business is worth, and online calculators can give you a rough estimate. However, if you’re selling your company, you need an in-depth, expert business valuation. If you don’t know how much your company is worth, you could unwittingly shortchange yourself.

Business brokers often perform business valuations themselves or work with certified business appraisers. If you don’t have a recent business valuation, your broker should be able to help you get one.

Gather and Organize Financial Records

When a buyer is considering purchasing your business, one of the first things they’ll look at is your financial records. These are some of the most important metrics for potential buyers:

Revenue over time and current revenue trends

Cash flow

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

Gross margin (funds remaining after direct costs are paid)

Net profit margin (funds remaining after all expenses have been paid)

Having well-organized financials can help reduce the stress that comes with selling your company. If a buyer asks to see financials and receives incomplete or disorganized documentation, they may be concerned that the rest of your company is disorganized, too.

Assemble Your Team

Selling your business is a major undertaking. Before you begin, it’s wise to assemble the right support team. Many business owners choose to hire the following people before they sell:

A business broker

An attorney

A CPA or other tax professional

A wealth manager

You might think that paying for attorneys, tax professionals, and wealth managers is unnecessary — even a waste of money. However, hiring them will often save you money in the long run.

Attorneys can prevent costly legal problems, and the right tax professional can help you avoid getting into trouble with the IRS. The right wealth manager can help you strategically invest the proceeds to get the most out of your money.

Take Steps to Improve Profitability

It’s never a bad thing to improve a business’s profitability. However, doing so right before a sale is particularly important. Potential buyers are willing to pay more for highly profitable businesses, especially if their profitability is trending upward.

Don’t Be Intimidated by the Sales Process

The process of selling a business is complex. Fortunately, you don’t have to handle the sale alone. Business brokers don’t just step in when it’s time to market your company — they can also guide you through the pre-sale steps you need to take.

It might be tempting to try to sell your business quickly. But when you take the time to prepare, you’ll likely be rewarded with better profits and a smoother experience overall.

Preparing Your Staff for a Business Sale

When it comes time to sell your business, one of the most delicate parts of the process involves your staff. Employees are the backbone of your operation, and how you prepare them for a transition can significantly influence the outcome of the sale. Mishandling communication or failing to set expectations can lead to uncertainty, reduced morale, and even turnover at a time when stability matters most.

Maintain Confidentiality Early On

In the early stages of selling a business, discretion is key. Sharing news too soon can lead to disruption in operations, speculation among employees, and unwanted attention from competitors or clients. During this period, your business broker will help ensure that interested buyers are properly screened and bound by non-disclosure agreements. This helps keep your team insulated while the initial work is handled behind the scenes.

Choose the Right Time to Communicate

While confidentiality is critical, there will come a point when you need to inform your staff. The timing depends on the nature of the sale, but typically, it is best to wait until a buyer is firmly in place and negotiations have reached a mature stage. This allows you to speak with more clarity and confidence about what lies ahead, minimizing guesswork and fear.

Be transparent but measured. Focus on what will stay the same, what might change, and what the transition means for the team. Clear communication can prevent rumors from spreading and help employees feel respected and involved.

Reassure Employees About Their Roles

A major concern for staff during a business sale is whether they will still have jobs afterward. If the buyer intends to keep the team intact, make that known. Reassurance about continued employment, pay, and benefits goes a long way in keeping the workplace calm and focused. If changes are expected, be honest while offering support and solutions.

Buyers often place high value on a business’s staff and their ability to maintain operations without interruption. A smooth transition in personnel can actually help raise the overall appeal and stability of your business during the sale process.

Include Key Staff in the Transition

Depending on your structure, it may be appropriate to loop in certain managers or senior staff members before informing the broader team. Trusted leaders can help facilitate a positive transition by reinforcing messages, answering questions, and continuing daily operations without disruption. Their insight can also be useful in preparing internal processes for a new ownership style.

In some cases, buyers may even request meetings with department heads to better understand the business. Including senior team members in select parts of the transition builds trust and ensures continuity.

Support and Stability During Change

Change can be unsettling, but strong leadership during a sale provides the reassurance your team needs. By approaching the process with honesty, respect, and thoughtful timing, you can help preserve morale and maintain the momentum your business needs to successfully pass into new hands.

When to Start Planning Your Business Exit

Deciding when to exit your business is one of the most pivotal moments in your entrepreneurial journey. Whether you’re driven by retirement goals, a desire to try something new, or changing market conditions, the timing and strategy behind your exit can dramatically impact your personal finances and the future of the business. Many owners wait too long, only to find themselves rushed and unprepared. In reality, the best time to start planning your business exit is well before you’re ready to leave.

Years in Advance, Not Months

Ideally, exit planning should begin three to five years before you intend to sell or transition ownership. That window allows time to clean up financials, improve operational efficiencies, and boost profitability. It also gives you the opportunity to put systems in place that allow the business to run independently of your daily involvement. Buyers want to see a strong foundation that won’t crumble once the original owner steps away.

This level of preparation isn’t something you can accomplish in a few weeks. Business valuation alone can involve months of reviewing records, identifying risks, and assessing market positioning. Starting early gives you more control, more options, and more leverage in negotiations.

Responding to Life and Market Conditions

Sometimes the decision to exit isn’t based on a timeline. Health issues, family obligations, or unexpected economic shifts can force the issue. Planning early ensures that if circumstances change suddenly, you’re not left scrambling. A business that is already set up for a smooth handoff will hold its value better in a time-sensitive sale.

Market cycles also influence the optimal time to sell. A strong economy or increased demand for businesses in your sector could drive interest and competitive offers. On the other hand, if the industry is slowing, it may be smart to plan ahead and look for the right window before valuations begin to drop.

Personal and Financial Readiness

A proper exit plan also factors in your personal goals. What do you want your life to look like after you leave the business? Will you need income from the sale to support retirement or other ventures? Starting early gives you time to align your business exit with your financial future, including tax strategies, estate planning, and long-term investment shifts.

Exiting a business can also stir up unexpected emotions. For many owners, their company is a core part of their identity. Thinking about the transition ahead of time helps you mentally prepare for that shift, making it easier to step away without regret.

Work With the Right Professionals

Business brokers, financial advisors, and legal experts play a key role in exit planning. They help you structure the process, value the business correctly, and screen potential buyers. Engaging with these professionals early in your timeline ensures your exit is thoughtful, well-coordinated, and positioned for success.

How to Screen Buyers Before Closing a Deal

Every financial decision you make in business and life is only as solid as the people you partner with. This is especially true in deals with elevated stakes, including your decision to sell your business. It’s not just a matter of announcing your pending sale and reviewing multiple parties. Instead, it’s the challenge of finding the right buyer to sell to.

What steps can you and your business brokers take to set up an effective and fair screening process? Here are a few ideas.

Confirm the Capital

Financial vetting is a crucial step in lining up a potential buyer. Your business broker analyzes interested parties to verify their access to capital, whether through funding or pre-approved loans. They can also uncover pitfalls early on, like unclear financials or delayed or questionable documentation.

Validating a buyer’s financial capacity legitimizes their prospects. It can deter the buyer from making lofty promises and stop wasting time on offers that can’t be completed.

Analyze Strategy and Motivation

Why is the buyer eager to take over your business? Are they positioning for growth and expansion? Do they have the relevant experience and expertise to maintain your business’s operations and good standing?

Buyers with good intentions may still be uncertain or unclear about their motivations. Learn what you can about their strategy, the nature of their interest, and whether they can keep the business running and preserve its legacy.

Evaluate Operational and Management Abilities

How does your prospective buyer conduct business? Do they work in an industry relevant to yours? How do they propose to handle staff management, customer relations, and the specifics of your business operations?

Lack of experience in buying a business isn’t necessarily a deal-breaker, but it must be carefully scrutinized. Experienced business buyers are more likely to understand the inner workings of their industry. They’re also in a better position to secure financing and facilitate a smoother turnover process. Determine whether their style and abilities in business operations and managing others fit with yours.

Maintain Confidentiality and Professionalism

Nothing jeopardizes a business deal more swiftly than the leak of sensitive information. A qualified buyer will have no problem signing a non-disclosure agreement (NDA) before negotiations begin. If they balk, consider that a major red flag.

There’s also something to be said for keeping an air of professionalism in the business sale process. A steady demeanor and clear communication style go a long way in identifying a partner’s seriousness about their business. Your business broker should be able to filter out casual shoppers from legitimate contenders.

Sealing the Deal With Assuredness

Buyer screening ultimately protects all parties in the sale of a business. It helps preserve the seller’s business value and reputation. It reassures returning employees that new management will take over smoothly and maintain operations. It’s also good for the buyer, allowing them to proceed with negotiations with their reputation understood. When you’re ready to sell your business, talk with your business brokers about their process for screening buyers and how it has worked in past deals.

Protecting Intellectual Property During Business Sales

When selling a business, most owners focus on tangible assets like equipment, inventory, or real estate. But for many businesses, the most valuable assets are intangible—your intellectual property (IP). Whether it’s a trademarked brand, proprietary software, customer databases, or trade secrets, your IP can be a major driver of your company’s valuation. That’s why protecting it throughout the business sale process is essential.

Identify and Document All Intellectual Property Assets

Before entering any discussions with potential buyers, create a clear inventory of your intellectual property. This includes:

Registered trademarks, service marks, or logos

Copyrighted materials (manuals, content, designs)

Patents or patent applications

Proprietary software or technology

Client lists or CRMs

Business processes, formulas, or trade secrets

Buyers will want to see these assets well-documented. If you can’t clearly identify and prove ownership of your IP, it may devalue your business—or raise red flags that stall the sale.

Ensure Ownership Is Legally Transferred and Protected

Ownership isn’t just about who uses the asset—it’s about who legally holds the rights. Make sure any IP created by employees, contractors, or vendors is clearly assigned to the business in writing. Review employment agreements and vendor contracts to ensure they include “work for hire” clauses and IP assignment provisions.

Without clear legal ownership, you can’t transfer those rights to a buyer, and that could unravel the deal during due diligence.

Use Non-Disclosure Agreements Early and Often

Before sharing any proprietary information, require potential buyers to sign a non-disclosure agreement (NDA). This protects you from having your intellectual property leaked, copied, or used against you—even if the deal doesn’t close.

An NDA should cover more than just financial statements. Include language that protects product formulas, customer lists, marketing strategies, software code, and any other sensitive information tied to your operations.

Control Access to Sensitive Information

It’s tempting to be transparent with an eager buyer, but over-sharing too soon can backfire. Use a staged approach to disclosure. At early stages, keep discussions general. As buyers become more serious and complete key milestones—like signing an NDA or showing proof of funds—you can grant controlled access to more detailed materials, often through a secure data room.

A business broker can help manage this process, ensuring confidentiality is maintained while still giving buyers what they need to move forward.

Include Clear IP Terms in the Purchase Agreement

Once you’re ready to finalize the sale, make sure the purchase agreement clearly outlines which intellectual property assets are being transferred. Spell out what’s included, what’s excluded, and how the handoff will occur.

Work with a legal advisor to ensure all IP filings are updated with the buyer’s information after closing. Trademarks, copyrights, and patents often require formal assignments or filings with federal agencies to make the transfer official.

Failing to properly transfer IP can result in disputes or missed protections for both parties. A clean transition ensures the buyer gets full value—and you avoid headaches down the road.

How to Pre-Qualify Buyers Before Listing Your Business

When you’re preparing to sell your business, one of the most important—yet often overlooked—steps is pre-qualifying potential buyers. While it’s easy to get excited by early interest, not every inquiry is worth your time. Some buyers may lack the financial means, industry experience, or genuine intent to follow through. Pre-qualifying buyers before listing your business can help you focus on serious prospects and avoid costly delays or failed deals.

Understand What Makes a Qualified Buyer

Not all buyers are created equal. Some may be well-funded investors, others may be competitors, and a few might just be curious entrepreneurs. A qualified buyer typically checks three boxes: financial capability, operational readiness, and strategic alignment.

Financial capability means they can access the funds needed to make the purchase—either through personal capital, bank loans, or investor backing. Operational readiness refers to their ability to take over management and continue the success of the business. Strategic alignment means the business fits their goals and expertise.

Ask the Right Questions Early On

When interest first comes in, it’s easy to want to move quickly. But a few strategic questions up front can filter out unqualified buyers. Consider asking:

What is your background in this industry?

How do you plan to finance the purchase?

Are you looking to be an owner-operator or hire management?

What attracts you to this specific business?

The answers will tell you a lot about their seriousness, experience, and how realistic they are about ownership.

Review Proof of Funds

A buyer might sound great on paper, but unless they can provide proof of funds or a pre-qualification letter from a lender, you could be wasting your time. Requiring financial documentation is a professional and necessary part of the process. It’s not about being intrusive—it’s about protecting your time, your staff, and your business reputation.

Working with a business broker ensures this step is handled discreetly and professionally, without turning away the right candidates.

Protect Confidentiality with a Non-Disclosure Agreement (NDA)

Before sharing detailed financials or proprietary information, have every buyer sign a legally binding non-disclosure agreement. This protects your business in case the deal doesn’t go through, and also weeds out casual browsers who aren’t ready to commit to the process.

A signed NDA also sets the tone: this is a serious process, and you expect buyers to treat it with professionalism and respect.

Work With a Broker to Qualify Buyers Before You Ever List

One of the biggest advantages of working with a business broker is that they often pre-qualify buyers before your business even goes on the market. Brokers have relationships with active, qualified buyers and know how to match your business with the right fit.

They also understand how to evaluate financials, read between the lines during conversations, and guide buyers through the pre-approval process—so you spend your time talking to serious prospects, not tire-kickers.

Retaining Employees During Ownership Transfer

Keeping your team intact is crucial when you sell your business. Your key employees understand how things run, know your customers, and carry your company’s culture. Buyers often expect that continuity, and they may walk away if top talent jumps ship.

In this guide, you’ll find practical ways to retain your team, protect your business’s value, maintain customer relationships, and support a smoother, more successful sale.

Transparent Communication (Without Breaching Confidentiality)

Clear, honest communication is key, but selling a company requires confidentiality. Time your announcements carefully. It’s often advisable to wait until a major milestone like signing a letter of intent or purchase agreement.

At that point, hold a team meeting or send a written notice explaining the basics of what is happening. For example, you might say the business is being sold and the buyer is committed to the company’s future, but avoid sharing sensitive numbers or negotiation details.

Assure staff that many of the company’s values, processes, and teams will stay the same. If possible, have the buyer speak with employees to reinforce this commitment.

Involve long-time employees in planning the transition (e.g., let them train the new owner on company norms). This inclusion makes them feel invested and less like outsiders will run everything.

Incentive Structures and Stay Bonuses

To motivate employees to stay through the transition, consider financial and non-financial incentives such as:

Stay bonuses

Retention agreements

Stock options, phantom shares, or a share of future profits

Career or role incentives

You can use these incentives to show employees they are valued and secure. Tailor them to individual motivations; not everyone is swayed by cash.

For some, new responsibilities or skill training during the transition can be equally compelling. The goal is to give staff a reason to stay engaged and focused instead of jumping ship.

Consider Hiring Business Brokers for a Smooth Transition

Experienced business brokers can be invaluable in managing employee retention. For instance, a good broker knows how to structure the sale so that listing information stays confidential and gives advice on when to tell employees.

In practice, brokers often act as intermediaries during the sale. They can coach you on crafting employee communications and timing announcements to minimize disruption. Many business brokers can also help negotiate retention packages or earn-out agreements that include employee incentives, aligning all parties’ interests.

By partnering with a knowledgeable broker, you gain a guide who ensures messaging is consistent and respectful of both confidentiality and employee needs. This support helps your team feel like the transition is organized and fair.

Keep Your Team and Strengthen Your Sale

When you use the right tactics, you can sell your business without losing the people who keep it running. Retaining your team ensures daily operations don’t skip a beat, preserves customer confidence, and hands over added value to the new owner.

You can protect morale and keep your company’s culture strong by talking openly with your team, offering fair incentives, and working closely with your broker. Taking these steps can make the ownership transfer smoother and the outcome stronger for everyone involved.

Preparing Financials Before Listing Your Business

Selling your business is a big step, and having clean, well-organized financials can make it a lot easier. Up-to-date records show buyers that your business is reliable and transparent, and this builds trust from the start.

Disorganized or incomplete records, by contrast, can raise red flags. Buyers may hesitate or back out if they see signs of disorganization. Taking the time now to sort your books can help ease the sale process and allow you to command a higher price.

Gathering Essential Financial Documents

Before listing your business, gather all core financial documents for the past few years. Key items include:

Income statements

Balance sheets

Federal tax returns

Cash flow statements

Year-to-date (YTD) financials

Recent bank statements

Having these ready in one place is critical. For instance, business brokers often use your P&L, tax returns, and other financials to estimate your business’s value and set the right asking price. At the same time, serious buyers and lenders typically also review these documents closely during due diligence.

Sharing complete, accurate records up front helps move the sale along faster and builds confidence in your business.

Ensuring Clean Books and Third-Party Verification

Once you have all the data, make sure your books are clean, reconciled, and up to date. Well-kept books that follow standard accounting rules (like GAAP) show buyers that your business is well-run and trustworthy.

If your accounting has been a little informal, such as relying only on cash-based records or missing some details, now’s the time to fix it.

It also helps to bring in a third party, like an accountant, to review your financials before you sell your business. Buyers put more trust in numbers that have been reviewed or verified by an outside expert. In many cases, a formal review (or even a basic audit) can greatly enhance credibility.

Identifying and Removing One-Time Expenses

As you tidy your books, look for expenses or revenue that won’t recur under new ownership.

Examples include:

Legal fees from a one-time lawsuit

Costs from relocating your office

A large bonus paid to yourself in a single year

By removing these one-time items, you can give buyers a clearer picture of what the business typically earns, making your company more attractive and easier to value.

Working With Advisors and Business Brokers

A trusted financial advisor, CPA, or business broker can help you understand your numbers and present them clearly to buyers. These professionals know exactly what buyers want to see.

For instance, business brokers can:

Collect your tax returns and income statements

Prepare a market-value analysis (MVA) to back up your asking price

Organize your financial documents for due diligence

Such experienced experts can save time, avoid costly mistakes, and give buyers the confidence they need to move forward.

Sell Your Business With Confidence by Planning Ahead

When your records are complete and any unusual items have already been explained, buyers spend less time asking questions and more time moving forward. Instead of uncovering problems, they’ll see proof of healthy cash flow and solid performance.

The effort will pay off when you can point to accurate numbers that support your asking price and sail through due diligence. With your finances in order, you’ll present a professional, trustworthy picture that makes selling your business a smoother, more rewarding process.

When to Sell Your Business for Maximum Value

You’ve poured years into building your company, and now you might be asking yourself if it’s time to sell. The truth is, timing plays a big role in how much you walk away with.

Selling at a high point instead of waiting until a downturn or personal burnout forces your hand usually means you’ll draw in more interested buyers and higher offers.

To get the best price when you sell your business, it’s important to keep an eye on both the market and your own business performance. That way, you can move forward when your value is at its peak.

Understand Market and Industry Trends

Start by reading the market. When the economy is strong and buyers have access to capital, competition heats up and valuations tend to rise. If your industry is booming or there’s high demand for your product, that creates more potential buyers, and a hot market often means higher offers. By contrast, selling in a cooling market or recession usually means accepting a lower price.

Capitalize on Your Business’s Momentum

Beyond the economy, look at your company’s own performance. Buyers pay for future promise, so your recent growth matters. If sales and profits are climbing, you’ll likely command a higher price. Conversely, once growth stalls or turns down, the valuation typically falls too.

Also, stability counts: a history of steady revenue and earnings can signal a well-run company. The best time to sell is often when things are going well, not after momentum has faded.

Assess Your Personal Readiness

Selling a business takes time and energy on top of your regular work. In fact, most deals take 6 to 12 months from listing to close, and during that time, you’ll likely be juggling the daily operations and the sale itself.

That’s why the best time to sell your business is when you still have the drive to handle the process and make the most of what you’ve built.

If you’re already burned out or counting the days until retirement, you may find negotiations and due diligence overwhelming. Plan ahead so you can tackle the sale while you’re sharp and engaged.

Stay Prepared and Seek Help

Keep your records organized, contracts in place, and operations running smoothly. That way, if a great opportunity appears, you can move fast.

If you have time, work on small improvements — fix minor issues, tie up loose ends, and lock in key customers — so prospective buyers can find a stable, well-run operation.

Business brokers and advisors can be a big help throughout this process. A good broker, for instance, can prepare marketing materials, connect you with serious buyers, and handle negotiations so you don’t have to manage everything yourself.

With an experienced advisor on your team, you’ll be more confident that you’re timing the sale correctly and not leaving money on the table.

Facing the Effort and Finding Relief

When you are selling your business, it’s normal to wrestle with uncertainty, worry about how employees and customers will react, and relive every high and low you’ve faced as an owner.

But here’s the upside: a solid plan and the right timing can ease much of that pressure. You can reduce stress, protect your energy, and leave knowing you made the most of what you built.

Understanding the Tax Implications When You Sell Your Business

Building a successful business takes hard work, and you want to get the maximum benefit when you’re ready to sell. Understanding the tax implications of a business sale can help you do that.

You can get hit by a few taxes depending on the type of sale, the ownership structure of your business, and your financial circumstances. However, the capital gains tax is the primary tax of concern.

How a Capital Gains Tax Impacts Selling Your Business

When you sell an asset, you pay a capital gains tax on the profit of the sale. A business is no different. When you sell your business, you may have to pay capital gains taxes if you show a profit from the difference between the sale price and the basis, or what you paid to acquire and improve your company.

Your capital gain could be huge, so the consideration you give to taxes can significantly impact how much money you walk away with. If you have owned your business for less than a year and sell, the short-term capital gain is taxed as regular income. A business owned longer than a year and sold is taxed as a long-term capital gain with tax rates of 0 percent, 15 percent, and 20 percent, depending on your income and filing status.

If your basis was $100,000 to start your business and you owned it for five years, a sale for $5 million would give you a capital gain of $4.9 million. At a capital gains tax rate of 20 percent, you would pocket $3.92 million.

Depending on where you live, you might also have to pay a state income tax. Business brokers can pull together a team of professionals, including a tax accountant, to build tax strategies to help you mitigate taxes from selling your business.

The Structure of Your Business Matters

The business structure you have impacts how taxes are paid. Your business might have one of the following structures:

Limited Liability Company (LLC)

Partnership

S Corporation

C Corporation

Taxes are a pass-through for the owners of LLCs, partnerships, and S corporations. That means you pay the taxes from the sale of a business. However, taxes on the sale of a C corporation get more complicated.

The Type of Sale

Selling your business can happen in two ways: an asset sale or a stock sale. As an LLC, partnership, or S corporation, you typically will not incur additional taxes on the sale of assets. However, when selling assets as a C corporation, you could be taxed twice — at the corporate and shareholder levels.

You can avoid that by selling the stock of the company. However, most buyers prefer to buy assets because they can deduct the cost of buying your company.

Tax Considerations Before You Sell Your Business

The terms of your deal can also determine the taxes you pay.

Cash at Closing: You receive cash at closing

Earn Out: The buyer pays some cash at closing, but the rest over time

Equity Rollover: You receive cash for some stock, but hold on to some

Seller’s Note: You allow the buyer to pay over time with interest

Taking cash at closing gives you the biggest capital gains tax hit, although your risk increases with the other terms.

Plan for Taxes Before You Sell

To keep as much of your business sale proceeds as possible, consider adding tax planning long before you sell your business. Business brokers can guide you in preparing for the tax implications of selling your business.

How to Determine the Value of Your Business

Whether you’re trying to attract investors or sell your business, knowing the value of your business is critical to its success. However, many small and medium business owners admit to not knowing the value of their enterprise.

Running your business without knowing its true worth can leave you at a disadvantage when someone inquires about buying your business. It can also cause you to miss out on growth opportunities.

For business owners, it can be easy to get caught up in day-to-day operations or simply not want to pay for a business valuation. However, working with business brokers can deliver a business valuation to help you get the most out of your business now and in the future.

What Is a Business Valuation?

A business valuation is the process of determining the economic worth of a company. It evaluates such key factors as financial performance, tangible and intangible assets, growth potential, and market conditions.

When selling your business, a proper business valuation can ensure you’re not leaving money on the table or you don’t have an overblown idea of your company’s value. Understanding how much your business is worth can also help you target growth, land a bank loan, attract investors, or plan your exit.

3 Common Types of Business Valuations

Every business is different, and you can — and should — evaluate a business in many ways. Taking different approaches to how much your business is worth can provide you with a range of its true value and demonstrate to others that you’ve done your homework.

Here are three common types of business valuations:

1. Asset-Based

Consider this approach if your business has significant assets. Total your tangible assets (property, machinery, and inventory) and intangible assets (brand, customer loyalty, goodwill, and patents), and subtract your liabilities.

2. Market-Based

This method compares your business to other businesses of comparable size, performance, and industry that have recently been sold.

3. Income-Based

If your business has strong potential for growth, an income-based valuation might be best. It focuses on the business’s ability to generate profits in the future. You can use a capitalization factor to project potential profits based on past earnings or determine a value based on discounted future earnings.

Earnings multiples is another common approach that applies a multiple to earnings, such as net income or EBITDA (earnings before interest, taxes, depreciation, and amortization). Other key factors include growth potential, your management team, and industry trends.

How to Value Your Business

Consider these steps to arrive at a sound business valuation:

Determine the reason for the valuation

Gather your financial records

Pick your valuation methods

Apply the methods

Consider key factors of your business

Compare the results of the valuation methods

Business brokers with deep and broad knowledge and experience in small and medium businesses can help you arrive at a proper valuation for your business.

A Business Valuation Is Critical to Your Business

Whether you want to sell your business, find investors, or improve your operations, knowing the true worth of your business is as crucial to its success as staying on top of the day-to-day operations.